Brief about OYO

(i) Oyo is a leading, new-age

technology platform empowering the large yet highly fragmented global hospitality ecosystem,

according to RedSeer. They have been focused on reshaping the short-stay accommodation space

since its incorporation in 2012 and have developed a unique two-sided technology platform

focused on comprehensively addressing key pain points of the Patrons (being the owners,

lessors and/or operators of storefronts listed on the platform) on the supply side and the

Customers (being travelers and guests who book accommodations at the Patrons’

storefronts through the platform) on the demand side. The unique business model helps the

Patrons transform fragmented, unbranded and under-utilized hospitality assets into branded,

digitally enabled storefronts with higher revenue generation potential and provides the

Customers with access to a broad range of high-quality storefronts at compelling price

points.

(ii) As at March 31, 2021, they had 157,344 storefronts

across more than 35 countries listed on the platform. The Patrons use the platform to manage

all mission-critical aspects of their business operations. The comprehensive, full-stack

technology suite integrates more than 40 products and services across the digital signup and

onboarding, revenue management, daily business management and D2C stacks into the two

flagship Patron applications, Co-OYO and OYO OS. This enables the Patrons to have a

significant digital presence across the extensive distribution network. The Customers can

book storefronts through its own D2C channels on the platform and through indirect channels

with third-party OTAs. The OYO mobile application offers a variety of digital tools to guide

the Customers throughout their journey, including discovery, seamless booking, pre-stay

assistance and cancellations, digital check-ins as well as in-stay and post-stay services.

Business Model of OYO

OYO business model relies on

the Patrons who list their storefronts on its platform and its large base of Customers who

book accommodations at Patrons’ storefronts through OYO platform. The value

proposition to the Patrons of OYO hotel and homes business is based on our integrated,

full-stack technology suite, which empowers all mission-critical aspects of their business

operations. In turn, the Patrons provide them with distribution rights (largely on an

exclusive basis) and significant control over pricing decisions relating to their storefront

inventory, which enables them to maximize their revenue generation potential through the

dynamic pricing algorithms. They distribute Patrons’ hotel and home

storefront inventory through the D2C channels on the platform and through indirect channels

with third party OTAs and generally earn an average revenue share of 20% to 35% of GBV (net

of discounts and loyalty points), which creates strong alignment between OYO and its

Patrons. They also offer a listing only service, where Patrons can list their storefronts on

the platform for a fixed subscription fee.

Asset-light Model of

OYO

They have an asset-light business model and a lean cost

structure. They do not own the storefronts listed on the platform. As at March 31, 2021,

99.9% of the storefronts did not have contracts with minimum guarantees or fixed payout

commitments from us, with any investments, capital expenditure, storefront employee costs

and other expenses relating to the operation of such storefronts borne large.

Hotels Listed on OYO

They have 157,344 storefronts

across more than 35 countries listed on the platform as at March 31, 2021. As at September

9, 2021, they had the largest footprint in terms of hotel storefronts in India and SEA and

the second largest footprint in Europe in terms of home storefronts among full stack

short-stay accommodation players, according to RedSeer. They have made a conscious strategic

decision to focus on these geographies as the Core Growth Markets. These markets account for

more than 90% of the total storefronts globally as at March 31, 2021.

1. Revenue from operations increased from ~3900 Cr in Fy21 to

~4700 Cr Fy22.

2. Adj. EBITDA loss have reduced from ~1700 Cr

in Fy21 to ~470 Cr in Fy22.

3. Gross Booking Value increased

from ~6600 Cr in Fy21 to ~8100 Cr in Fy22.

4. OYO is now

shifting focus from rapid growth to sustainable growth to make OYO profitable.

5. Currently, OYO core focus markets are India, South East Asia

and Europe Homes.

6. IPO is expected to come in next

year.

Key takeaways from OYO 2022-23 Annual Reports

1. OYO reported a 14% increase in Total Income for FY23,

reaching ₹5602 crore from ₹4905 crore.

2. The company

significantly reduced its Net Losses by 34%

3. Adjusted EBITDA

losses also saw a remarkable decrease of 68%, narrowing to ₹-374 crore from ₹-1160 crore in

the previous year

4. The company has launched 10 Palette

resorts in cities including Jaipur, Hyderabad, and Mumbai, with plans to add 40 more Pallete

Resort to its portfolio by Q2 FY 2024.

5. IPO is expected to

come this Year.

Valuation of OYO Unlisted Shares

|

Shareholidng as on 31.03.2023

|

| |

|

|

|

|

Equity Shares |

132 Cr

|

|

|

|

Preference shars |

473 Cr

|

Bonus 3999:1 |

Conversion 1:1 |

| Series

A |

80,160 |

320640000 |

320640000 |

| Series

A1 |

111,730 |

446888430 |

446888430 |

| Series

B |

102,250 |

408977910 |

408977910 |

| Series

C |

166,690 |

666673470 |

666673470 |

| Series

C1 |

104,600 |

418375560 |

418375560 |

| Series

D |

322,790 |

1290917370 |

1290917370 |

| Series

D1 |

12,910 |

51707250 |

51707250 |

| Series

E |

137,000 |

547943160 |

547943160 |

| Series

F |

143,750 |

574936410 |

574936410 |

| Series

F2 |

800 |

3279360 |

3279360 |

| |

|

|

473 Cr

|

|

Total Shares

|

605 Cr

|

|

|

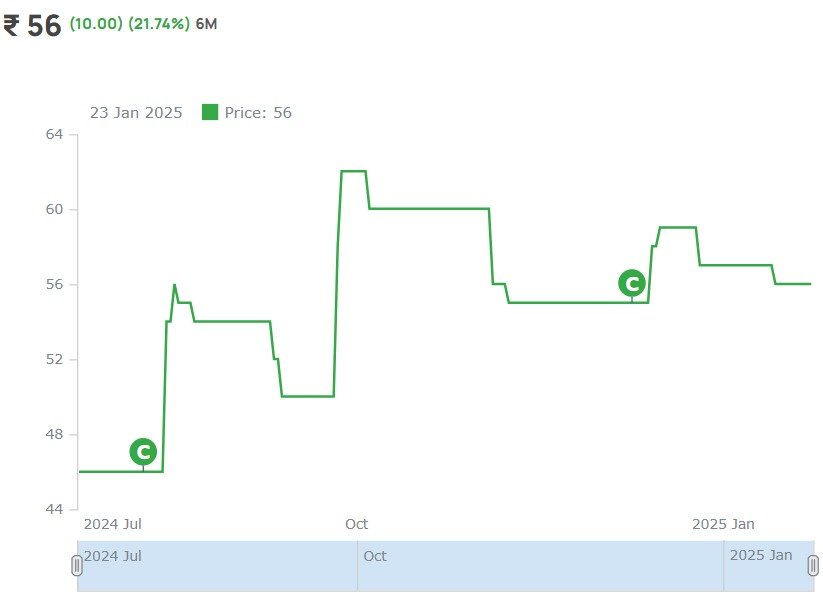

In the months of July and August-24, OYO raised approximately INR 1,457 crore in Series G

funding at a price of around INR 30 per share. This infusion adds roughly 50 crore shares to

the company's capital. Consequently, as of August 2024, the total outstanding shares stand

at approximately ~650 crore.

With the stock price of OYO in the unlisted market at INR 45, this results in a valuation of

INR 29,250 crore or approximately $3.65 billion.