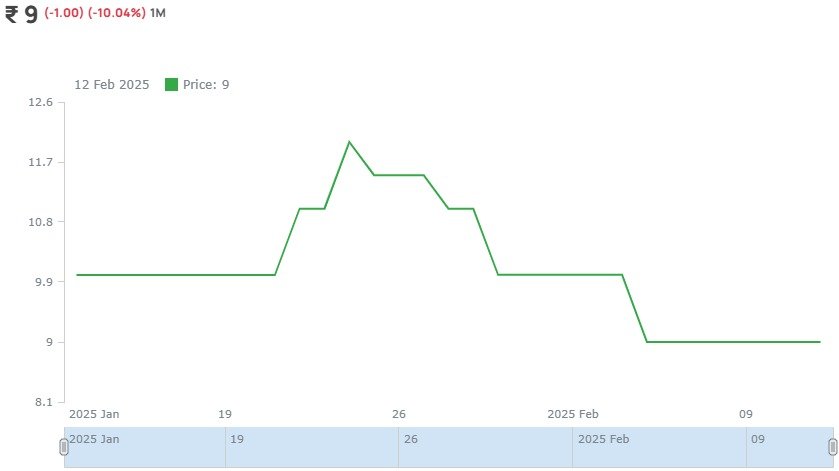

15 Days Price Change

PharmEasy Unlisted Shares

-

PharmEasy

-

414719

-

₹ 9

-

(-106.00) (-92.17%) 5Y

5 Year

3 Year

1 Year

6 Month

1 Month

About PharmEasy Unlisted Shares

Pharmeasy Share Price Full Details About the

Company

PharmEasy is India's leading digital healthcare

platform. It provides information, consultations, diagnostics tests, medicines,

healthcare products, and services from registered and trusted pharmacies, leading

diagnostic laboratories, and trusted doctors across India, serving every habitable

zip code of the country. The journey of PharmEasy was started in 2015, when founders

Dharmil Sheth, an MBA from IMT Ghaziabad and Dr. Dhaval Shah, MBBS from Rajiv Gandhi

Medical College and MBA from XLRI Jamshedpur, came up with the idea of an online

pharmacy to make healthcare affordable and accessible to one and all.

Overview of PharmEasy

They are India’s largest

digital healthcare platform (based on GMV of products and services sold for the year

ended March 31, 2021), according to RedSeer Report. They operate an integrated,

end-to-end business that aims to provide solutions for the healthcare needs of

consumers across the following critical stages A. providing digital tools and

information on illness and wellness.

B. Offering Teleconsultation.

C. Offering diagnostics and Radiology tests.

D. delivering treatment

protocols including products and devices. PharmEasy custom-built proprietary

technology, unified data platforms, supply chain capabilities, and a deep

understanding of the dynamic interplay between the various sub-segments of India’s

healthcare market are the capabilities that differentiate us.

These

capabilities enable PharmEasy to provide each stakeholder in the healthcare

value-chain, viz.: (a) channel (wholesalers, retailers, and chemists/institutions).

(b) consultants (and hospitals), diagnostic and radiology labs. (c) consumers (d)

companies (pharmaceutical, nutraceutical,medical devices.

The businesses have

a presence across the country, with last-mile 163 capabilities to deliver in over

18,587 pin codes (for June 2021) via PharmEasy marketplace, allowing the ability to

provide access in an affordable manner to the common man. The platforms have scaled

across urban, semi-urban, and rural India, with an ability to serve people across

income groups and geographies.

Journey of PharmEasy

2015 - Started the journey in Mumbai and received angel

funding.

2016 - Received Series-A funding and expanded into

5 cities. The same year they have started a home-diagnostics service.

2017 - Received Series-B funding and expanded into 700

cities. Launched online delivery of health care products.

2018 - Received Series-C funding and expanded PAN India

presence.

2019 - Received Series-D funding and expanded

more than 22000+ PIN codes.

2020- It has got merged with

Ascent Health and 5 other companies to form API Holdings, to form India’s biggest

online healthcare company.

2021 - It has purchased 66%

stakes in Thyrocare and this is the first listed company to be acquired by any

Unicorn in India. Currently, there is a team of 4000+ dedicated employees and have

more than 10000+ retail stores working 24*7 to ensure medicines are delivered on

time and at the best possible prices.

Funding History

| March 2016 | ~34 Crores |

| March 2017 | ~104 Crores |

| April 2017 | ~13 Crores |

| February 2018 | ~13 Crores |

| September 2018 | ~350 Crores |

| September 2018 | ~2800 Crores |

| November 2019 | ~1650 Crores |

| April 2021 | ~2400 Crores |

| June 2021 | ~150 Crores |

Product and Services

If you check the website of PharmaEasy,

you will find the following services;

(i) Order Online

Medicine

How does it work?

Step-1: The

buyer needs to upload the prescription. Once PharmEasy receives it, they verify and

send the same to the Medical stores near the pin code.

Step-2: PhameEasy delivery agent then collects medicine

from Pharmacy and delivers it to the user.

(ii) Healthcare

Products Similar to buying the medicine you can buy various healthcare

products such as Nutritions, Personal care, Skin Care, Ayurvedic Products,

Life-Style Ailments Products.

(iii) Diagnostics Tests Under

this service, you can book diagnostics tests under PharmEasy labs. PharmEasy labs is

a diagnostic service offered by its partner lab Medlife Labs directly. Medlife is

now being acquired by PharmEasy. As they have recently acquired Thyrocare, they are

giving the option to book tests for these labs as well.

PharmEasy

Business Model

The business model is very simple and

straightforward. It connects buyers, suppliers, and distributors. Buyer has the

option to choose services such as Medicine, Health-Care Products, book diagnostic

tests, etc from the application and website. They get 1-2% commission on selling

medicines, they get advertisement money for displaying products of various

pharmaceuticals, Nutraceuticals, companies, etc., and also get income from

diagnostics tests.

Fundamentals

Per Equity Share

Financials (Figures in Cr.)

P&L Statement

| P&L Statement | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Revenue | 2335 | 5729 | 6644 | 5664 |

| Cost of Material Consumed | 2267 | 5342 | 5669 | 4737 |

| Gross Margins | 2.91 | 6.76 | 14.67 | 16.37 |

| Change in Inventory | -114 | -229 | 62 | 143 |

| Employee Benefit Expenses | 270 | 1459 | 1283 | 699 |

| Other Expenses | 482 | 1502 | 1051 | 731 |

| EBITDA | -570 | -2345 | -1421 | -646 |

| OPM | -24.41 | -40.93 | -21.39 | -11.41 |

| Other Income | 25 | -1185 | -2866 | 931 |

| Finance Cost | 43 | 258 | 666 | 728 |

| D&A | 33 | 159 | 243 | 216 |

| EBIT | -603 | -2504 | -1664 | -862 |

| EBIT Margins | -25.82 | -43.71 | -25.05 | -15.22 |

| PBT | -621 | -3977 | -5196 | -2522 |

| PBT Margins | -26.6 | -69.42 | -78.21 | -44.53 |

| Tax | 21 | 22 | 15 | 11 |

| PAT | -642 | -3999 | -5211 | -2533 |

| NPM | -27.49 | -69.8 | -78.43 | -44.72 |

| EPS | -25.08 | -6.51 | -8.48 | -3.9 |

Financial Ratios |

2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Operating Profit Margin | -24.41 | -40.93 | -21.39 | -11.41 |

| Net Profit Margin | -27.49 | -69.8 | -78.43 | -44.72 |

| Earning Per Share (Diluted) | -25.08 | -6.51 | -8.48 | -3.9 |

Balance Sheet

| Assets | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Fixed Assets | 128 | 1025 | 912 | 734 |

| CWIP | 0.2 | 7.8 | 4 | 3.6 |

| Investments | 1 | 438 | 342 | 329 |

| Trade Receivables | 358 | 861 | 905 | 706 |

| Inventory | 406 | 761 | 688 | 556 |

| Other Assets | 4011.8 | 8305.2 | 5405 | 6061.4 |

| Total Assets | 4905 | 11398 | 8256 | 8390 |

| Liabilities | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Share Capital | 25.6 | 614.2 | 614.2 | 649.6 |

| FV | 1 | 1 | 1 | 1 |

| Reserves | 3555.4 | 6408.3 | 1823 | 1938 |

| Borrowings | 585 | 2585 | 4120 | 4098 |

| Trade Payables | 365 | 459 | 413 | 413 |

| Other Liabilities | 374 | 1331.5 | 1285.8 | 1291.4 |

| Total Liabilities | 4905 | 11398 | 8256 | 8390 |

Cash-Flow Statement

| Cash-Flow Statement | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| PBT | -620 | -3971 | -5196 | -2522 |

| OPBWC | -427 | -1474 | -637 | -214 |

| Change in Receivables | -99 | -226 | -112 | 30 |

| Change in Inventories | -112 | -195 | 73 | 133 |

| Change in Payables | 74 | -18 | -45 | -0.5 |

| Other Changes | -238 | -592 | 39 | 26.5 |

| Working Capital Change | -375 | -1031 | -45 | 189 |

| Cash Generated From Operations | -802 | -2505 | -682 | -25 |

| Tax | -12 | -84 | -62 | -36 |

| Cash Flow From Operations | -814 | -2589 | -744 | -61 |

| Purchase of PPE | -31 | -143 | -95 | -72 |

| Sale of PPE | 1 | 5 | 8 | 10 |

| Cash Flow From Investment | 4 | -5789 | -72 | -1261 |

| Borrowing | 15 | 2016 | 652 | -231 |

| Divided | 0 | 0 | -23 | -29.5 |

| Equity | 399.2 | 6344 | 548 | 2000 |

| Others From Financing | 605.8 | -55 | -324 | -282.5 |

| Cash Flow from Financing | 1020 | 8305 | 853 | 1457 |

| Net Cash Generated | 210 | -73 | 37 | 135 |

| Cash at the Start | 20 | 230 | 157 | 192 |

| Cash at the End | 230 | 157 | 194 | 327 |

Shareholding Pattern

Peer Ratio

| Particulars (cr) | Revenue (Fy24) | PAT (Fy24) | P/E (17/01/2025) | Mcap (17/01/2025) |

| NCDEX | 96 | -29 | NA | 1500 Cr |

| MCX | 684 | 83 | 88x | 30000 Cr |