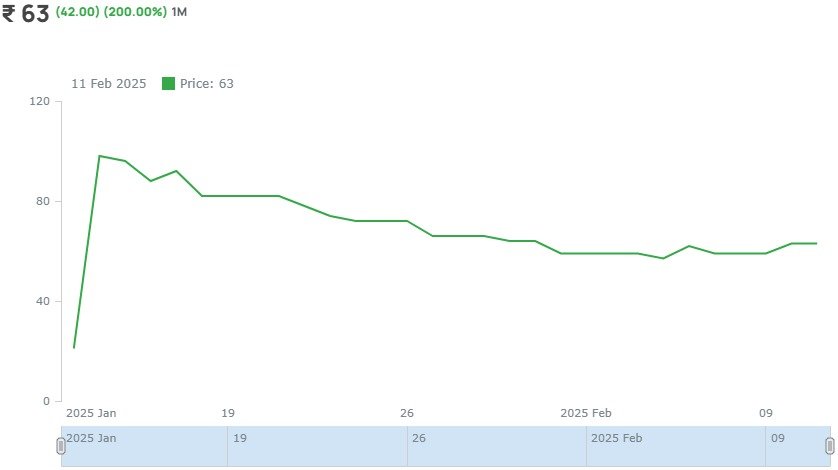

15 Days Price Change

Polymatech Unlisted Shares

-

Polymatech

-

300464

-

₹ 63

-

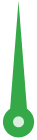

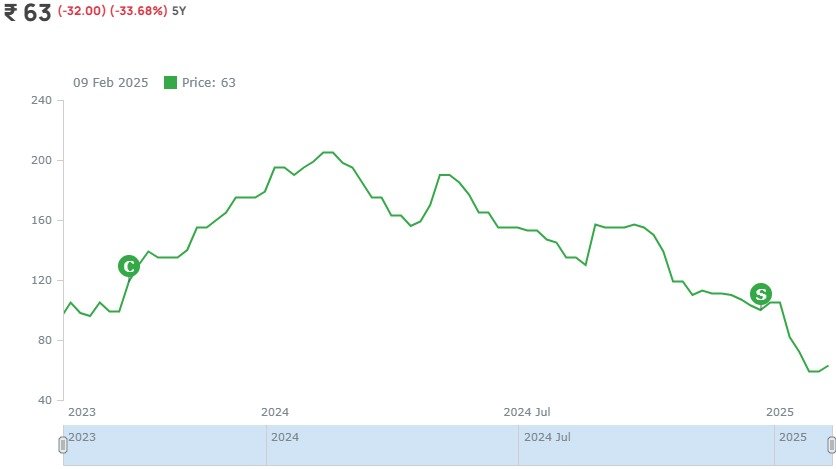

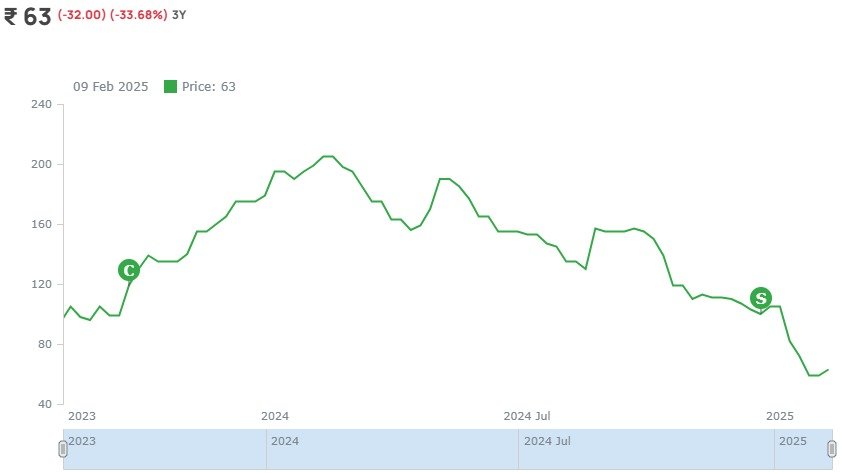

(-32.00) (-33.68%) 5Y

5 Year

3 Year

1 Year

6 Month

1 Month

About Polymatech Unlisted Shares

1. Introduction: Polymatech Unlisted Share is an Indian company that was incorporated in 2007 as a subsidiary of Polymatech Company Ltd, Japan. However, in 2018, it was completely acquired by Mr. Eswara Rao Nandam and his wife, Mrs. Uma Nandam, Chennai-based entrepreneurs. Mr. Eswara Rao Nandam, an alumnus of BITS Pilani, is a key promoter in the company. PEL specializes in manufacturing LED semiconductor chips and has a production facility in the SIPCOT Hi-Tech SEZ in Oragadam Kancheepuram, Tamil Nadu. The company aims to become a world leader in the manufacturing of Elastometer parts.

2. Previous Ownership and Acquisitions: Before the 2018 acquisition by Mr. Eswara Rao Nandam and his wife, Polymatech was controlled by Polyma Asset Management Company from Japan and Polymatech (Malaysia) with shareholdings of 52.20% and 47.80%, respectively. The company faced challenges in the past, as it was involved in manufacturing and supplying keypads for mobile phones, which became obsolete around 2011-12. Due to declining demand, the company incurred losses and struggled to sustain its operations.

3. Post-Acquisition Transformation: After the acquisition in 2019, the new management shifted the company’s focus to manufacturing semiconductor chips for LEDs and Luminaries. Polymatech currently produces Opto Semiconductors used in high-power lighting systems, ICs, and Sanitizing LEDs for hospital applications.

4. Financial Performance: Since the acquisition, Polymatech unlisted share has witnessed significant growth in its financial performance. In FY20, the company generated approximately 2 Crores in revenue with a loss of 27 lakhs. However, in FY21, the revenue surged to 45 Crores with a profit after tax (PAT) of 7 Crores. The growth trend continued in FY22, with revenue reaching 126 Crores and a PAT of 34 Crores.

5. Manufacturing Capacity Expansion: Polymatech is planning to expand its manufacturing capacity from the current 300 million chips per year to 20 billion chips per year by 2024. This expansion is crucial to accommodate the increasing demand for its semiconductor chips. For this the total money to be deployed would be ~1 Billion dollar. Polymatech Electronics Unlisted Share manufacture products and same is mentioned below.

c) Logic Chips

d) Memory Chips

e) LED Chips

6. Shareholding and Valuation: As of 31st March 2022, Mr. Eswara Rao Nandam and Mrs. Uma Nandam were the primary investors in PEL. In the unlisted market, the company’s shares were trading at Rs. 400 per share, resulting in a market capitalization of 2540 Crores based on approximately 6.35 Crore outstanding shares. The EPS for FY22 based on these outstanding shares stands at 5.35, and the P/E ratio is 74x. However, as per media news in FY22-23, some other investors have invested in the company.

7. Management and Board Structure: The company is supported by Japanese nationals, who serve as Chief Technology Officers (CTOs) and are also members of the board of PEPL. The acquisition by Mr. Eswara Rao Nandam and his wife in 2019 brought new leadership and direction to the company, resulting in its successful transformation.

8. Future Prospects: With the growing demand for LED semiconductor chips in various industries, including lighting systems and sanitization applications, Polymatech unlisted share is well-positioned for further expansion and profitability. The company’s commitment to increasing its manufacturing capacity and its focus on innovative technologies will likely drive future growth.

9. Conclusion: Polymatech Electronics Limited has experienced a remarkable turnaround since its acquisition by Mr. Eswara Rao Nandam and Mrs. Uma Nandam. The company’s shift to LED semiconductor chip manufacturing has proved to be a successful strategy, leading to substantial revenue and profit growth in recent years. With its expansion plans and favorable market dynamics, PEL holds strong potential for continued success in the semiconductor industry.

Polymatech Electronics Limited Unlisted Shares Price

As of July 2023, Polymatech Electronics Limited Unlisted Shares Price is Rs.525/share.

Fundamentals

Per Equity Share

Financials (Figures in Cr.)

P&L Statement

| P&L Statement | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Revenue | 45 | 126 | 649 | 1221 |

| Cost of Material Consumed | 34 | 102 | 468 | 780 |

| Gross Margins | 24.44 | 19.05 | 27.89 | 36.12 |

| Change in Inventory | -1 | -18 | -16 | -79 |

| Employee Benefit Expenses | 0.6 | 0.7 | 1 | 27 |

| Other Expenses | 0.6 | 1.5 | 12 | 189 |

| EBITDA | 10.8 | 39.8 | 184 | 304 |

| OPM | 24 | 31.59 | 28.35 | 24.9 |

| Other Income | 0.5 | 0.5 | 0.6 | 17 |

| Finance Cost | 0.8 | 2.4 | 3 | 0.13 |

| D&A | 3 | 3 | 16 | 50 |

| EBIT | 7.8 | 36.8 | 168 | 254 |

| EBIT Margins | 17.33 | 29.21 | 25.89 | 20.8 |

| PBT | 7 | 35 | 167 | 270 |

| PBT Margins | 15.56 | 27.78 | 25.73 | 22.11 |

| Tax | 0 | 0 | 0 | 30 |

| PAT | 7 | 35 | 167 | 240 |

| NPM | 15.56 | 27.78 | 25.73 | 19.66 |

| EPS | 1.1 | 5.52 | 23.26 | 30.15 |

Financial Ratios |

2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Operating Profit Margin | 24 | 31.59 | 28.35 | 24.9 |

| Net Profit Margin | 15.56 | 27.78 | 25.73 | 19.66 |

| Earning Per Share (Diluted) | 1.1 | 5.52 | 23.26 | 30.15 |

Balance Sheet

| Assets | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Fixed Assets | 83.5 | 90 | 155 | 446 |

| CWIP | 0 | 0 | 0 | 0 |

| Investments | 0 | 0 | 0 | 139 |

| Trade Receivables | 7.3 | 26 | 133 | 520 |

| Inventory | 1 | 20 | 36 | 267 |

| Other Assets | 2.2 | 1 | 64 | 244 |

| Total Assets | 94 | 137 | 388 | 1616 |

| Liabilities | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Share Capital | 63.4 | 63.4 | 71.8 | 79.6 |

| FV | 10 | 10 | 10 | 10 |

| Reserves | -22 | 13 | 252 | 713 |

| Borrowings | 32 | 45 | 43 | 21 |

| Trade Payables | 20 | 15 | 20 | 276 |

| Other Liabilities | 0.6 | 0.6 | 1.2 | 526.4 |

| Total Liabilities | 94 | 137 | 388 | 1616 |

Cash-Flow Statement

| Cash-Flow Statement | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| PBT | 7 | 36 | 167 | 240 |

| OPBWC | 10 | 37 | 183 | 318 |

| Change in Receivables | -7 | -18 | -107 | -386 |

| Change in Inventories | -1 | -18 | -16 | -231 |

| Change in Payables | 18 | -4 | 4 | 256 |

| Other Changes | 3 | 3.48 | -20 | 313 |

| Working Capital Change | 13 | -36.52 | -139 | -48 |

| Cash Generated From Operations | 23 | 0.48 | 44 | 270 |

| Tax | 0 | 0 | 0 | -16 |

| Cash Flow From Operations | 23 | 0.48 | 44 | 254 |

| Purchase of PPE | -31 | -9.9 | -80 | -342 |

| Sale of PPE | 0 | 0 | 0 | 0 |

| Cash Flow From Investment | -31 | -9.9 | -80 | -477 |

| Borrowing | 8 | 10 | -4 | -22 |

| Divided | 0 | 0 | 0 | 0 |

| Equity | 0 | 0 | 0 | 6.46 |

| Others From Financing | 0 | -0.6 | 81 | 219.54 |

| Cash Flow from Financing | 8 | 9.4 | 77 | 204 |

| Net Cash Generated | 0 | -0.02 | 41 | -19 |

| Cash at the Start | 0.006 | 0.001 | 0.03 | 41 |

| Cash at the End | 0.01 | -0.02 | 41.03 | 22 |

Shareholding Pattern

Peer Ratio

| Particulars (cr) | Revenue (Fy24) | EPS (FY24) | Mcap (21.10.24) | P/E (21.10.24) |

| Polymatech | 14780 | 34 | 470250 | 55x |

| BSE | 1592 | 57 | 57203 | 96x |